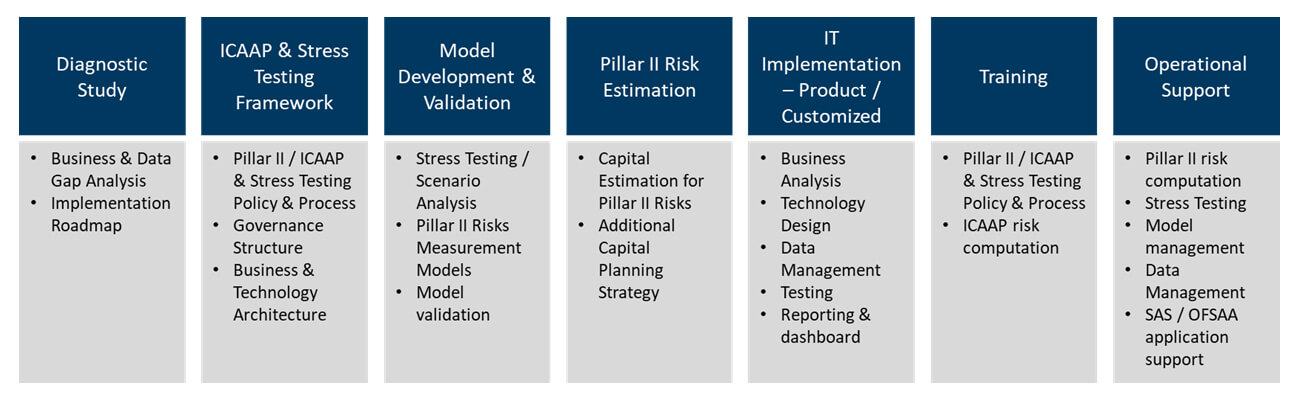

Credit Risk Management

BFS institutions are already in journey for Basel II / III implementation for credit risk. However, the implementations face challenge due to lack of domain knowledge, lack of modelling knowledge, lack of data knowledge and finally, lack of knowledge of IT solution being implemented.

RiskIntellect is well placed to help BFS organizations in their journey. We have an experienced team of credit risk experts, modelling experts, data management & IT product experts in our team. We have extensive experience in Basel II & Basel III implementation of standardized as well as advanced approaches for leading BFS institutions. We also have baseline documentation, data models, templates to fast track the project. Snapshot of our credit risk management services is provided below. Please refer Project Showcase for some of the projects executed by our consultants.

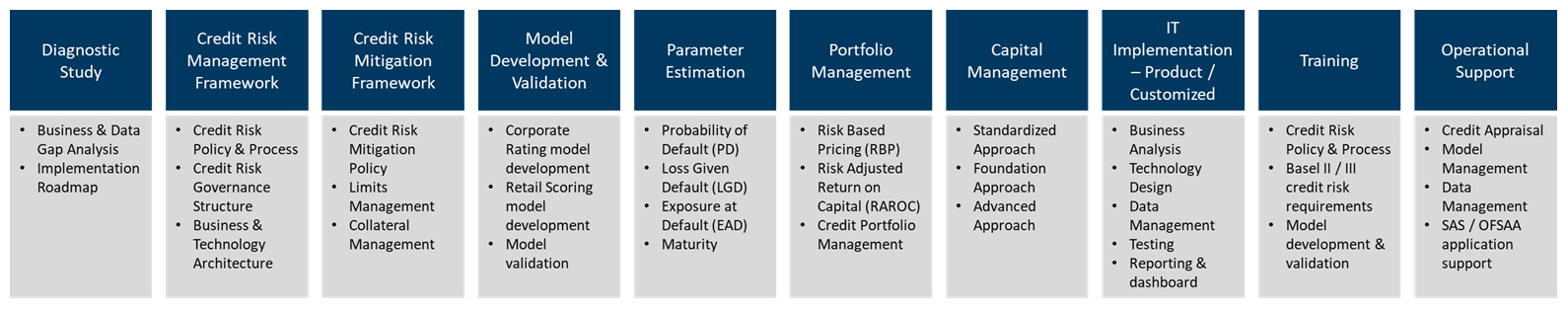

Market Risk Management

With the advent of Basel guidelines on ‘Front Office Review of Trading Book’, there have been substantial changes to Basel Market Risk Management framework.

RiskIntellect is well placed to help BFS organizations in this journey. We have an experienced team of treasury & market risk experts, modelling experts, data management & IT product experts in our team. We have extensive experience in Basel II & Basel III implementation of standardized as well as advanced approaches for leading BFS institutions. We also have baseline documentation, data models, templates to fast track the project. Snapshot of our market risk management services is provided below. Please refer Project Showcase for some of the projects executed by our consultants.

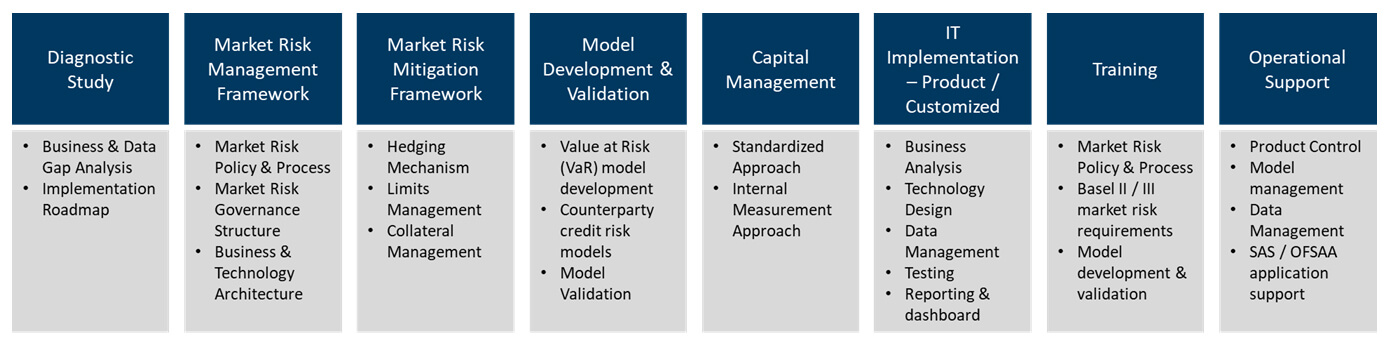

Operational Risk Management

Basel has provided ‘principle based guidance’ for Operational Risk Management. As a result, there are diverse practices followed by the BFS organizations and the granularity and depth of information is also different. Also, Operational Risk being enterprise wide in nature, it represents a major challenge for implementation.

RiskIntellect is well placed to help BFS organizations in this journey. We have a team of BFS industry & OR experts, modelling experts, data management & IT product experts in our team. We have extensive experience in operational risk implementation for leading BFS institutions. We also have baseline documentation, data models, templates to fast track the project. Snapshot of our operational rate risk management services is provided below. Please refer Project Showcase for some of the projects executed by our consultants.

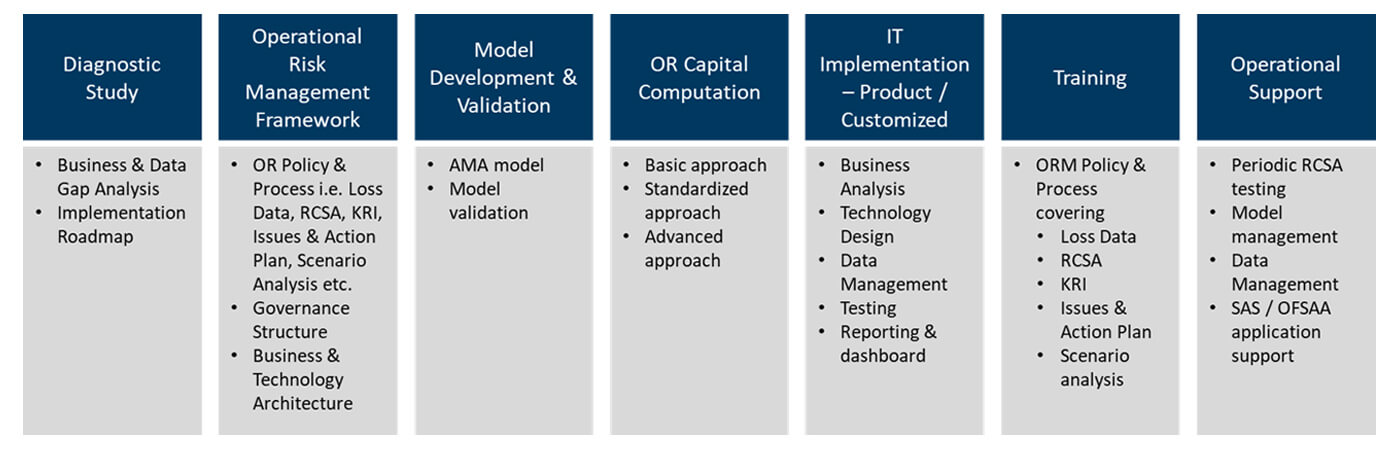

Pillar II / Internal Capital Adequacy Assessment Process (ICAAP) / Stress Testing

Internal Capital Adequacy Assessment Process (ICAAP) and Stress Testing are two important components of the assessment of Basel Pillar II risks. Pillar II risks being more qualitative in nature, present a unique challenge in assessment.

RiskIntellect is well placed to help BFS organizations in this journey. We have a team of BFS industry & risk management experts, modelling experts, data management & IT product experts in our team. We have extensive experience in Pillar II / ICAAP / Stress Testing implementation for leading BFS institutions. We also have baseline documentation, data models, templates to fast track the project. Snapshot of our pillar II / ICAAP / stress testing services is provided below. Please refer Project Showcase for some of the projects executed by our consultants.